W2 to Paystub Reconciliation

The information presented below is intended as an example to aid in reconciling an employee’s December pay advice to their W-2. If December pay transactions required corrections after the December payroll was processed there may be additional steps that need to be taken to reconcile the W-2 information.

If you have any questions relating to your W-2, contact your agency’s payroll specialist. In addition to receiving your W-2 in the mail, the W-2 can be accessed by using the Employee Self Service system (ESS) or contact your agency’s payroll specialist to receive a duplicate. Duplicate W-2 requests must be in writing. In order to protect the employee, verbal requests will not be accepted.

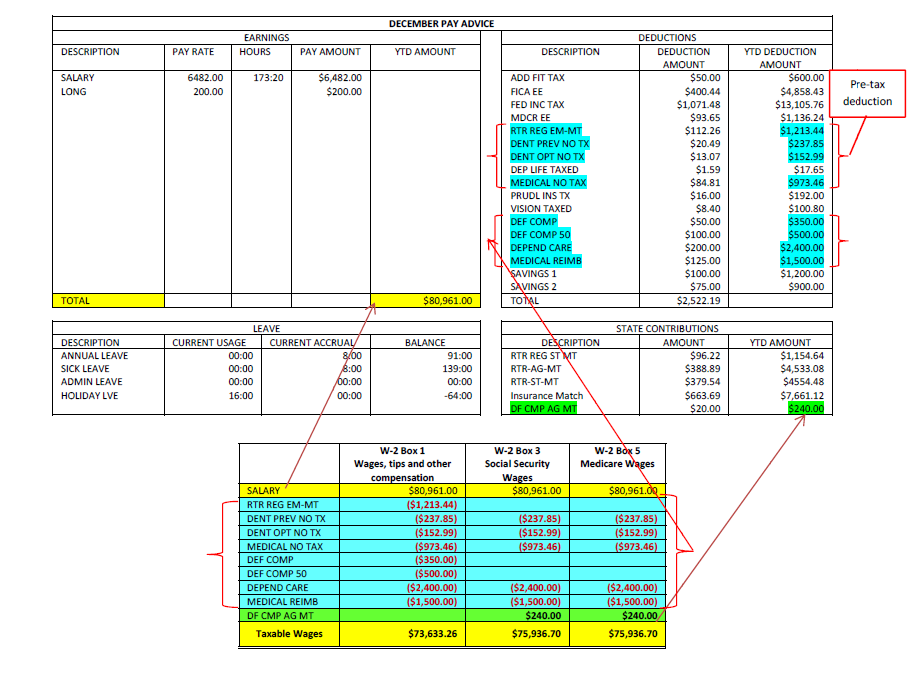

The State of Wyoming has several benefit programs, which may result in a difference between employees’ total earnings, their taxable federal income tax wages, and taxable Social Security/Medicare wages. These programs are: deferred compensation, various types of flexible benefit programs, and an option to have medical and life insurance premiums paid with pre-tax dollars. Depending on the benefit program participation elected by an employee, not all pre-tax deductions apply to all employees. The example below is intended to demonstrate how an employee can reconcile their December Pay Advice to their W-2.

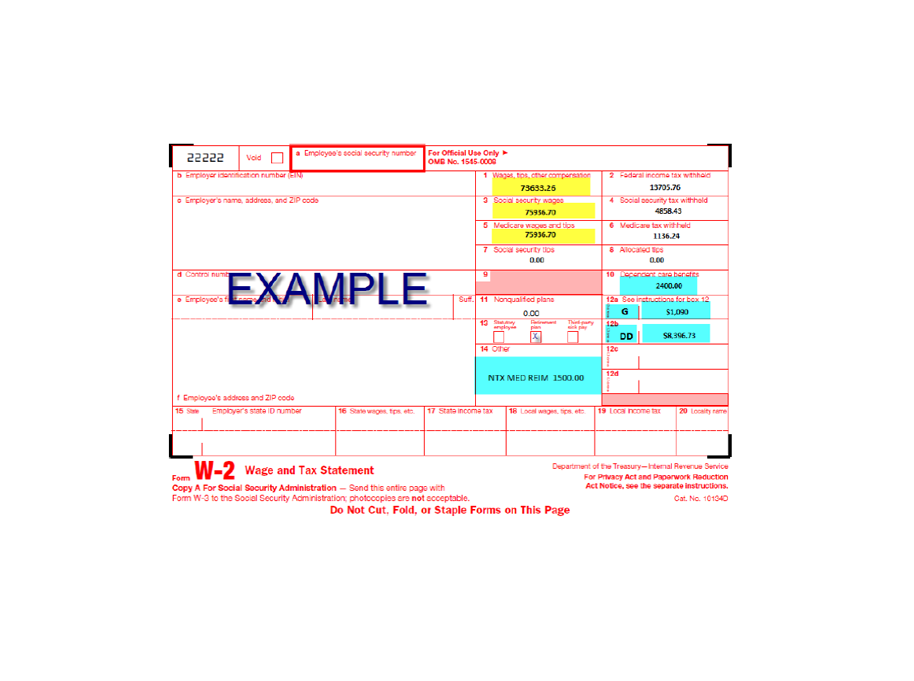

Box 1 (Wages, tips and other compensation) – indicates total wages, and taxable fringe benefits less pre-tax deductions that are subject to federal income tax withholding (Box 2).

Box 3 (Social Security wages) and Box 5 (Medicare wages and tips) – indicate wages and taxable fringe benefits less pre-tax deductions that are subject to Social Security taxes (Box 4) and Medicare taxes (Box 6).

The other boxes on the W-2 are for informational reporting purposes.

Box 10 (Dependent care benefits) – indicates the total pre-tax amount withheld for dependent care for those employees who elected to participate in the dependent care flexible benefit program.

Box 12-(G) (Deferred Compensation Section 457(b)) – indicates the total employee pre-tax deduction [e.g. DEF CMP or DEF COMP 50] withheld from the employees total earnings plus the total employer agency match [DF CMP AG MT].

Box 12-(P) (Excludable Moving expenses) – indicates those moving expense reimbursements paid directly to an employee that are otherwise deductible by an employee and paid under an accountable plan.

Box 12-(W) (HSA Deduction) – indicates the total pre-tax amount contributed to a Health Savings Account (HSA).

Box 12-(DD) (Cost of Employer – Sponsored Health Coverage) – indicates both the portion of the cost paid by the employer and the portion of the cost paid by the employee, regardless of whether the employee paid for the cost through pre-tax or after-tax contributions.

Box 12-(EE) (Designated Roth Contributions) – indicates the total employee Roth after-tax contribution made under a Governmental Section 457(b) plan.

Box 14-(2) (Medical Reimbursement) – indicates the total pre-tax amount withheld for medical reimbursement for those employees who elected to participate in the medical flexible benefit program.

Box 14-(3) (Moving Expense paid) – indicates those moving expense reimbursements paid directly to an employee that are otherwise not deductible and paid without qualified accountable plan. These reimbursements are included in Box 1 (Wages, tips and other compensation).

Box 14-(4) (Educational Assistance Payments) – indicates those tuition expenses that exceed $5,250.00 and are included in Box 1 ((Wages, tips and other compensation).

Box 14-(5) (Car Expense) – indicates the value assigned to the benefit of using an employer-owned vehicle for both business and personal use and is included in Box 1 (Wages, tips and other compensation).